Summary

SnoBase now flags overstocked and understocked SKUs at the distribution-center level.

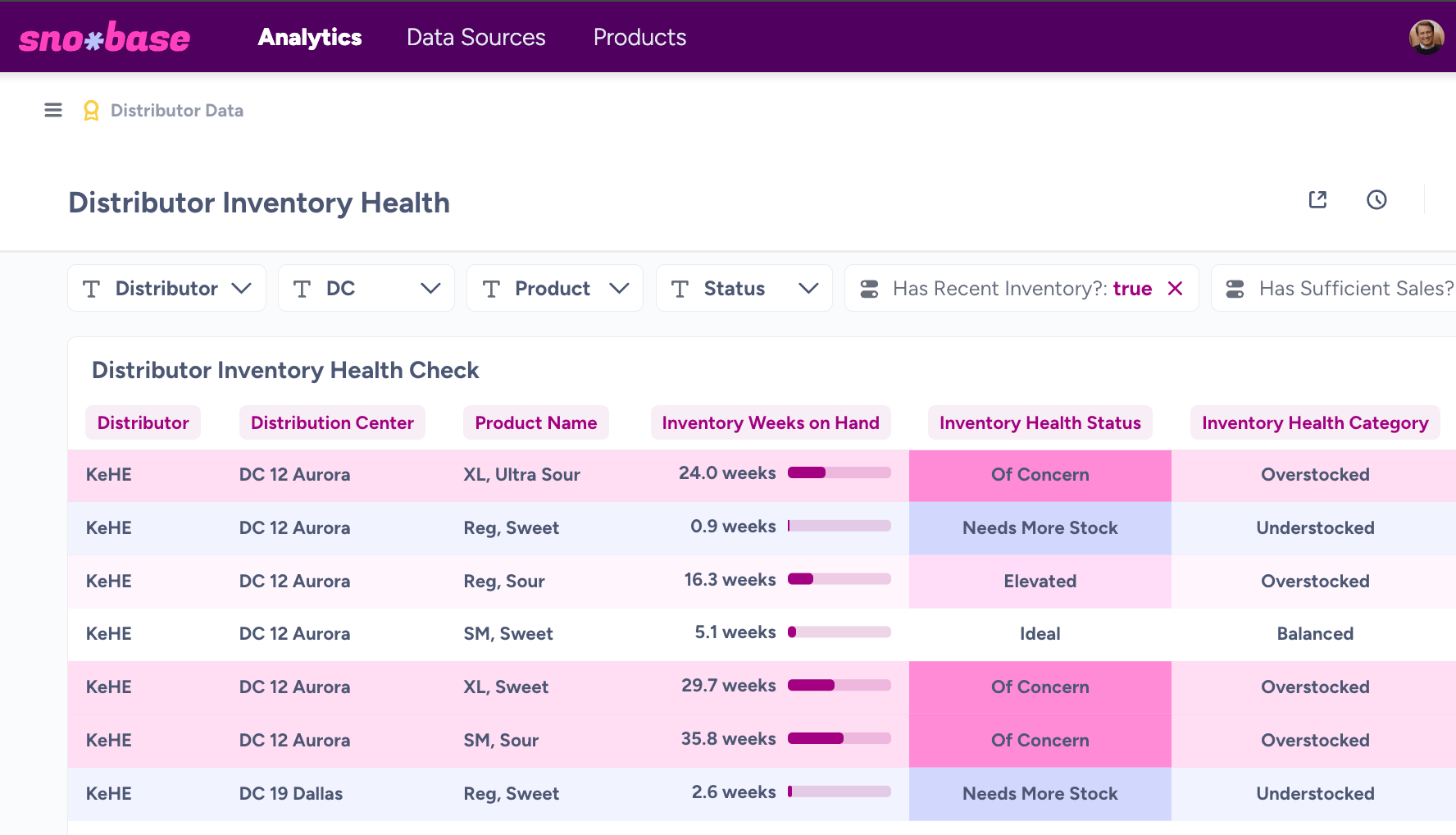

Our new Inventory Health Check uses synced distributor data to calculate ideal weeks on hand and automatically classify each SKU/DC combo as Needs More Stock, Ideal, Elevated, or Of Concern.

What’s New in SnoBase

Distributor Inventory Health Check

What

Each row in your Distributor Inventory Health Check reflects live status:

Needs More Stock – distributor needs to reorder soon to avoid out-of-stocks.

Ideal – inventory is in a healthy range.

Elevated - slightly above the ideal range, but trending to sell through eventually.

Of Concern – overstocked and needs attention.

Brands can now filter to Needs More Stock and immediately see which POs should go in before you call your buyers. On the flip side, filter to Of Concern and those days of forgotten over-orders languishing in a DC until a big deduction comes through should be a thing of the past.

How

Our new Inventory Health Check automation syncs data from multiple distributors on a weekly basis as well as the latest available sales data, develops a point of view of ideal inventory weeks on hand, and runs a customized decision tree from there to classify each SKU/DC permutation.

Why

On the one hand, “when is that next PO coming from X” is an extremely common question that this now answers in about 5-10 seconds. On the other hand, there is nothing more frustrating than an unexpected chargeback for product you could’ve sold elsewhere, but didn’t realize was sitting in a warehouse somewhere counting down the days until it was tossed in the trash.

Distributor data shouldn’t just sit in a dashboard, it should be integrated into real workflows that increase margin and revenue at the same time.

This feature turns your inventory visibility into an action list. Instead of guessing, you know exactly which products need attention and where.

Kudos

As we continue to focus on making distributor data immediately actionable for CPG brands, we want to thank Taza Chocolate and Nightingale Ice Cream Sandwiches for helping us explore this problem space.

If you like this feature, buy their products.

If you hate this feature, tell me why — and still buy their products, they’ll help you get over it.

What We’re Thinking About

How far can data visibility alone go in bridging the alignment gap between distributor buyers and brands and what still stands in the way? We’re asking where things break down and which gaps matter most.

Rainy Day Thought

While it takes a rightful back seat to the human impact, from a system lens we’re thinking about the SNAP program and how it ties into the grocery distribution supply chain in America. Over 3.5% of grocery bills are paid via SNAP. With the way the grocery supply chain works, that is a lot of groceries sitting on shelves that will not be purchased. This is bound to have ripple effects for months to come.

If you can, please consider donating to a local food bank.

Last SnoBasic’s Rainy Day Thought on distributor management sparked longer thoughts that I wrote about here 👉 Distributors in Grocery CPG.

Learn More and Connect

Upcoming Events:

SFA Fancy Faire — Jan 11–13 — San Diego, CA

Brands Book a Call: Brand Call Link

Distributors Book a Call: Distributor Call Link

Email Me Directly: [email protected]